Leadership

Meet Our Leadership

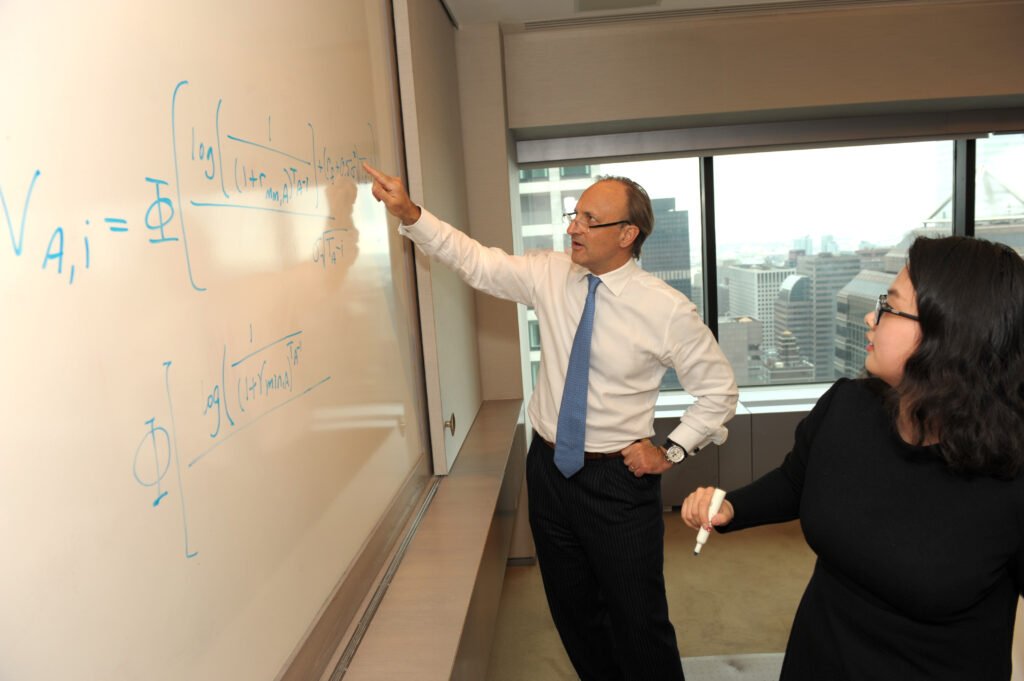

Carlos Abadi is a 30-year veteran international investment banker who pioneered a number of financial products, such as the trading and swapping of emerging markets sovereign loans in the wake of the 1982 Mexican debt crisis, the trading market for derivatives on emerging markets bonds and loans, the first non-dilutive CET1 transaction compliant with Basel III rules, and the first Chapter 11 filing for a Latin American issuer.

Carlos A. Abadi

Managing Director